Stock Information

General Meeting of Shareholders

Stock Information

(As of September 30, 2025)

| Stock Exchange Registration | Tokyo Stock Exchange, Prime Market |

|---|---|

| Stock Code | 9869 |

| Number of Shares Authorized | 72,000,000 |

| Number of Shares Issued | 35,000,000 |

| Minimum Trading Units | 100 Shares |

| Number of Shareholders | 6,581 |

Major Shareholders

(As of September 30, 2025)

| Name of Shareholder | Number of Shares [thousand] |

Ratio of Shares [%] |

|---|---|---|

| The Master Trust Bank of Japan, Ltd.(Trust Account) | 3,389 | 11.00 |

| MITSUI & CO., LTD. | 1,576 | 5.11 |

| Plus Double Co.,Ltd. | 1,280 | 4.15 |

| Mitsubishi Corporation | 893 | 2.90 |

| Kato Kosan Co., Ltd. | 850 | 2.75 |

|

Custody Bank of Japan, Ltd. (Trust Account) |

846 | 2.74 |

| Kewpie Corporation | 841 | 2.73 |

| HOUSE FOODS GROUP INC. | 838 | 2.72 |

| KAGOME CO., LTD. | 731 | 2.37 |

| JP MORGAN CHASE BANK 385632 | 646 | 2.09 |

Breakdown of Shares by Type of Shareholder

(As of September 30, 2025)

| Number of Shareholders | Component Ratio [%] | Number of Trading Unit | Component Ratio [%] | |

|---|---|---|---|---|

| Financial Importnstitutions | 14 | 0.22 | 47,088 | 13.46 |

| Financial Instruments Businesses | 23 | 0.35 | 2,437 | 0.70 |

| Other Corporations | 136 | 2.07 | 131,165 | 37.49 |

| Foreign Corporations, etc. | 210 | 3.19 | 68,482 | 19.58 |

| Individuals and Others | 6,197 | 94.15 | 58,604 | 16.76 |

| Treasury Stock | 1 | 0.02 | 41,990 | 12.01 |

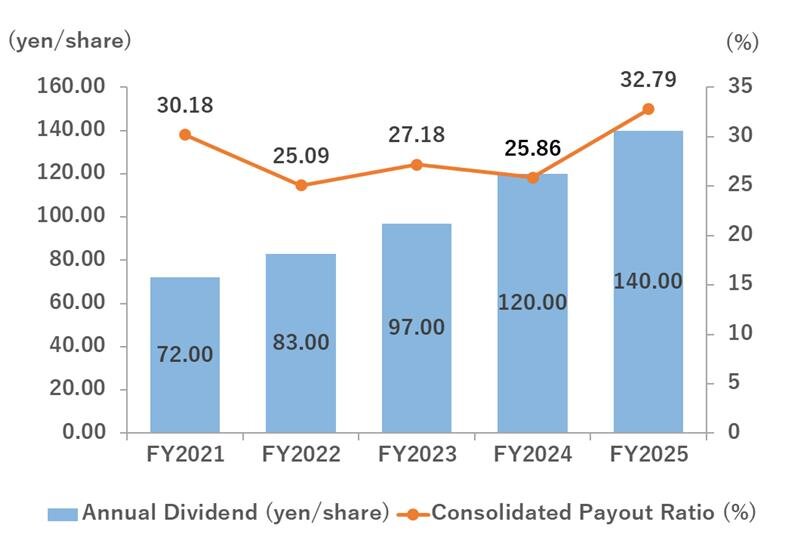

Basic Policy on Profit Sharing

We recognize that returning our profits to our shareholders is an important policy of management. Committed to a progressive dividend policy, we will pay a dividend that is stable and commensurate with business performance while improving our earning capacity and enhancing our financial structure. As a general rule, we will increase the dividend amount up to 20 yen per share every year, with the aim of gradually raising the dividend payout ratio to 40%. We have also decided to pay dividends of surplus twice a year in the interim dividend and year-end dividend, and as for the decision-making body of the dividend of surplus, the shareholders meeting is the body for the year-end dividend and the board of directors is the body for the interim dividend.

| Record Date | Decision-Making Body | Start of Payment Date | |

|---|---|---|---|

| Interim Dividend | March 31 | Board of directors | Early in June (estimated) |

| Year-end Dividend | September 30 | Shareholder meeting | Late in December (estimated) |

Dividend History

| FY2021 | FY2022 | FY2023 | FY2024 | FY2025 | FY2026 (forecast) |

|

|---|---|---|---|---|---|---|

| Interim Dividend(yen/share) | 36.00 | 38.00 | 47.00 | 55.00 | 70.00 | 80.00 |

| Year-end Dividend(yen/share) | 36.00 | 45.00 | 50.00 | 65.00 | 70.00 | 80.00 |

| Annual Dividend(yen/share) | 72.00 | 83.00 | 97.00 | 120.00 | 140.00 | 160.00 |

| Consolidated Payout Ratio(%) | 30.18 | 25.09 | 27.18 | 25.86 | 32.79 | 34.46 |

Previous Dividend Payments

IR Calendar